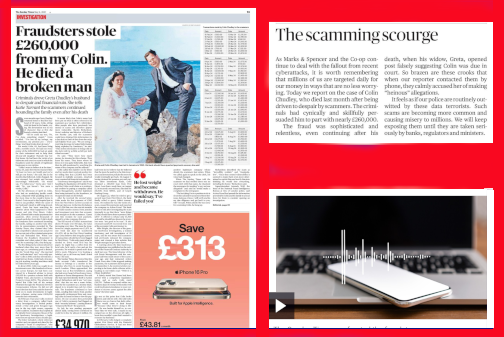

We asked the Sunday Times to highlight the case of scam victim Colin Chudley who died after months of harassment by fraudsters during which he lost £260,000.

The newspaper launched an investigation into the case and contacted the scammers who were still trying to extort more money from Colin, unaware that he had died. The recording can be heard here.

We are delighted to say that the Sunday Times has now committed itself to continuing to expose these scams until those in power start to take proper action.

The newspaper’s reader column read: “It feels as if our police are routinely out-witted by these data terrorists. Such scams are becoming more common and causing misery to millions. We will keep exposing them until they are taken seriously by banks, regulators and ministers.”

As a campaigning law firm we have agreed to help the Sunday Times to highlight the latest fraud issues.

Colin had fallen victim to an incredibly sophisticated scam that seemed to emanate from the fraudsters obtaining his data from an old investment con which had occurred more than a decade ago.

The new complicated scam involved scammers first claiming Colin was owed more money from the original investment fraud, then telling him he needed to pay into an insurance scheme and finally posing as fraud recovery experts so he paid them more money.

The latest scam, which occurred after he died, was trying to persuade him that he needed to pay them £40,000 or that he would have to attend the High Court in London as a witness in a trial, every day for 18 months to two years.

Shockingly, it is only since the media involvement that the police have now agreed to properly investigate this tragic case.

The head of the National Fraud Intelligence Bureau at the City Of London Police, originally told the newspaper that Action Fraud had passed the information to a local force for them ‘to consider opening an investigation’.

This is despite the fact there are clear lines of enquiry for the police to investigate. As part of the scam, tens of thousands of pounds had been passed through a ‘money mule’. During the newspaper investigation the Sunday Times spoke to this person who claimed she was a single mother. Clearly, this needs to be looked into further.

It is our belief that Colin was let down by his bank who should have spotted the fraudulent on his bank account. We are determined to recoup all of the money for Colin’s widow. First Direct, which is owned by HSBC, has initially refused to reimburse the family.

We will continue to highlight this terrible case as we support the victim’s family.

The Government urgently needs to do more to protect its citizens from fraud. At the moment it is being out-thought and out-gunned by scammers from across the globe.

The Sunday Times did a fantastic job at telling the story which can be read in full here.

Have you lost money to a scam? Contact National Fraud Helpline. Call 0333 0033218 or fill out our Claim Form.